Solar loans enable clients to borrow money from a lender or solar programmer for the installation of a solar PV system.

A huge selection of solar loans for homeowners offerings are available with different monthly payment amounts, interest rates, lengths, credit conditions, and safety mechanisms. Some solar loans for homeowners provide bundling of energy efficiency improvements together with the solar PV installation or allow for addition of roof replacement or energy-related improvements.

Some solar loans for homeowners require an advantage to serve as collateral to secure the loan. When the lender requires a security interest in the solar customer’s house, it’s known as a home equity loan. Other loans do not require an asset to collateralize the loan aside from possibly the solar system itself.

These are known as unsecured loans. With many solar loans, the solar PV system can begin saving the homeowner money straight away by structuring the repayment provisions so the monthly payments are significantly less than the consequent reduction in the sum on your energy bill.

Alternatively, paying of the loan earlier and more than a shorter duration may delay immediate positive cash flow, but will shorten the time required to enter the post-loan period when monthly savings will be much greater.

Lenders for solar loans may be banks, credit unions, state programs, utilities, solar programmers, or other personal solar financing businesses.

In a few states, on-bill funding through participating utility companies allows solar clients to repay their loans through payments additional to their monthly electric bill. R-PACE is a mechanism for funding residential energy updates whereby the update is repaid within an assigned period of years through an assessment on the homeowner’s property tax bill.

An R-PACE assessment attaches to the property rather than the homeowner, which may make it easier for homeowners to buy a solar PV system even when they might want to sell their home before the system is completely repaid.

In a handful of countries, a country or quasi-state agency provides residential loan programs which cover solar. For information on these state solar loan programs, see the State Loan Programs for Solar Projects map accessible through the DSIRE website at www.dsireusa.org.

Personal loans that cover solar might also be available on your jurisdiction.

Solar Loan Interest Rates – What Are Solar Financing Rates

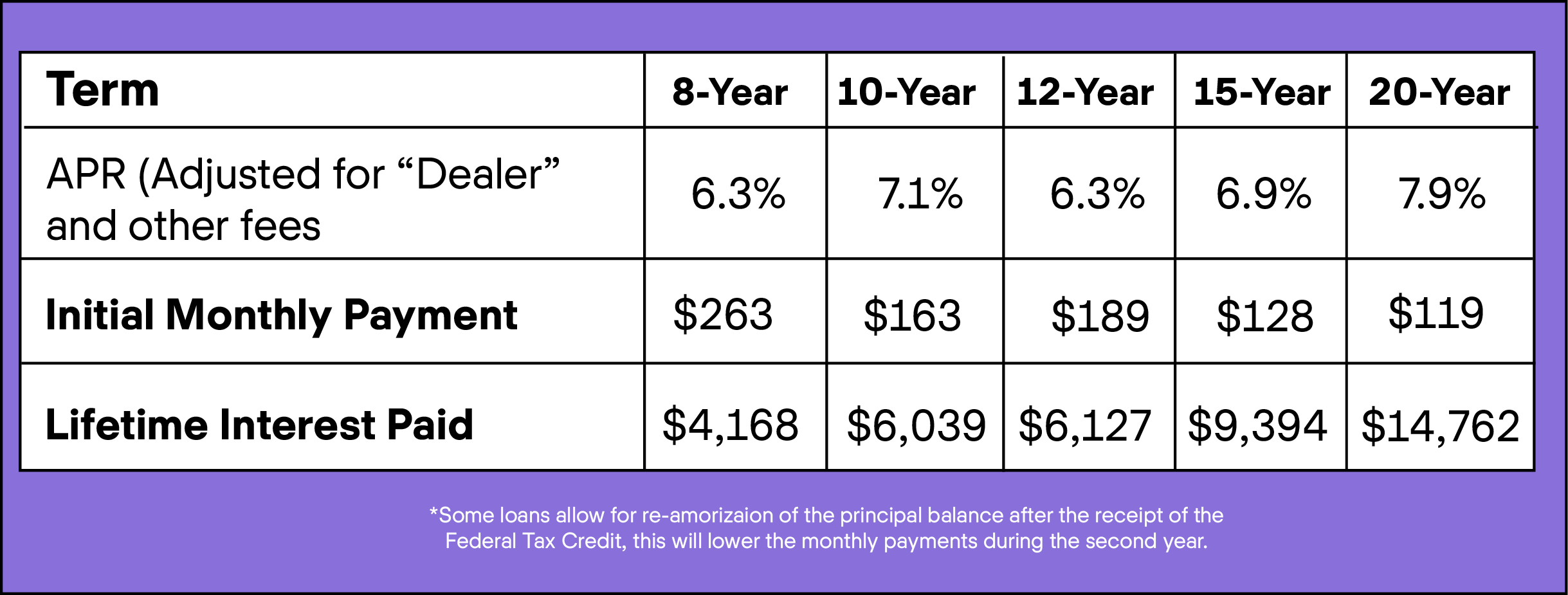

Let us discuss the solar loan interest rates that are typically available on the market. On the short end, there are 5 year loans, not unlike many auto loans. In the long end, there are several 20 year maturities and even a couple 25 year old solar loans, appearing more akin to a house mortgage. There are many offerings in between these extremes. So, the way to decide amongst the solar financing rates options? For starters, it ought to be known that short-term loans have lower rates of interest than long-term loans. A normal 5 year loan might have an effective APR at the 6 percent range, while a 20 year loan may have speeds closer to 8 percent. It doesn’t appear to be a massive gap, but over the duration of the various loans’ lifetimes you could wind up paying $12,000 more attention on the 20 year loan on a normal system.

You might ask, why not just go for the shorter term loan? The reason is simple: the longer the duration, the longer time the borrower must repay the principal balance of the loan. This allows for smaller monthly payments, a characteristic lots of people find attractive.

While the 8-year loan featured above has a rather low life interest cost, the monthly payment will most likely not allow for instant savings on the solar system. In other words, the solar system’s monthly payment may actually be greater than the energy cost that it eliminates. However, for a borrower taking a long-term perspective, the shorter term loan might actually be the best alternative; since at the end of years he or she’ll be paying for solar, with 100 percent of the electrical savings remaining in his pocket. Since solar systems normally have an expected lifetime of 25 years (or longer), that is at least 17 years of free energy being generated by the panels.

Many installers have a lender and loan product they’re most comfortable with, and have a tendency to promote this without consideration of their homeowner’s needs. Homeowners are usually overly preoccupied with the particulars of their solar equipment they are buying to ask questions regarding the loan they’re being offered, especially the loan maturity. Be certain you examine the loan and maturity choices available. If your installer doesn’t give you a range of choices, do some research and discover an alternative which better suits your needs and tastes.

Solar Loan Companies

Dividend Solar

Provides renewable energy and energy-efficient financing solutions to property owners. EmpowerLoans and PACE financing available. No lease or PPA options. Sells and installs solar power systems through affiliated partners.

Solar Five

Specializes in residential and commercial solar systems with monitoring. Offers rooftop LIDAR panels and ground-mounted systems. Purchase, lease, loan and PPA options. Installs in one to three months. Includes 25-year warranty.

EnergySage

Provides free solar energy educational resources. Helps homeowners compare solar power quotes and find local solar installers. Partners with Go Solar California, Massachusetts Clean Energy Center and Environment America.

Affordable Solar

Based in New Mexico, Affordable Solar provides supplies, financing and logistic support for solar businesses, contractors and installers. The Elite Installer Program gives customer support and discounts on equipment to businesses.

LightStream

LightStream is an online lending service. They do not offer solar leases, PPAs or installation. The company offers unsecured personal loans for a variety of uses, including solar panels.

Mosaic

Mosaic is a solar energy company that partners with solar contractors. The company provides solar loans on systems and batteries. Mosaic also provides a digital platform that connects you with your solar provider.

REC Solar

Based in San Luis Obispo, California, REC Solar provides logistical and financial support for businesses in multiple sectors installing solar energy systems. The company’s projects span more than 20 states and Puerto Rico.

Renew Financial

Renew Financial lends to California and Florida homeowners who build energy- or water-saving improvements on their home. Renew also offers commercial loans for businesses and multifamily residential projects.

Sunlight Financial

In business since 2007, Sunlight Financial offers homeowners and solar providers a customizable set of solar loan products. The company helps customers go solar with no money down.

VERT Solar Finance

VERT Solar Finance is a solar financing company that provides tax equity, funding and advising to large companies, property owners, developers and investors working on large-scale solar projects in North America.